With TBR’s Digital Transformation market and competitive intelligence research, gain insight into how technology and services firms are investing, going to market, partnering and more as they help enterprises transition to digital solutions.

Learn how IT and business buyers approach digital applications, platforms and services within the context of disruptive market trends and emerging opportunities. Additionally, examine and dissect IT vendors’ ecosystem management as well as investments, performance and go-to-market strategies in both mature and emerging areas, including blockchain, Industrial IoT, analytics, customer experience and innovation centers, and cloud.

A free trial of TBR’s Insights Center platform gives you access to our entire Digital Transformation research portfolio and the ability to customize and curate reports detailing our analysis based on your company’s specific needs. Start your free trial today!

Trends we’re watching in 2026:

- Customer experience becomes the battleground of AI for growth

- Data as the new (old) currency

- How vendor portfolio offerings evolve to avoid the GIGO (garbage-in-garbage-out) effect when on clients’ site

- Discretionary spend takes a new shape as IT buyers continue to shoulder more risk than the business, presenting an opportunity for vendors to deliver on service-level outcomes enabled by agents

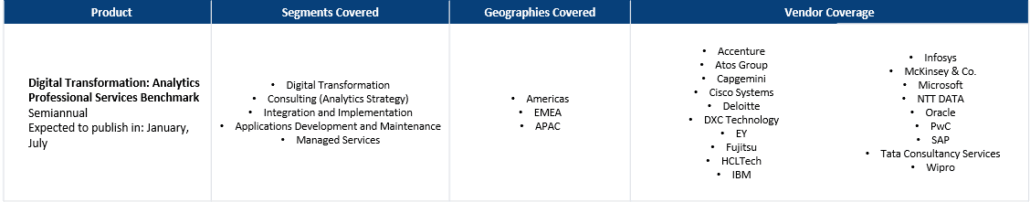

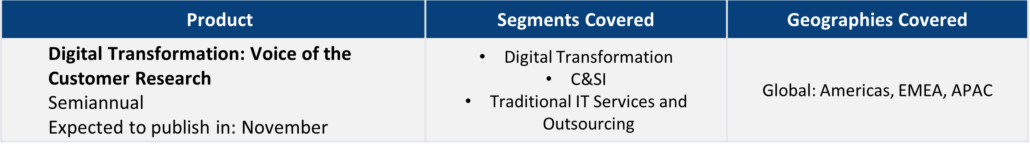

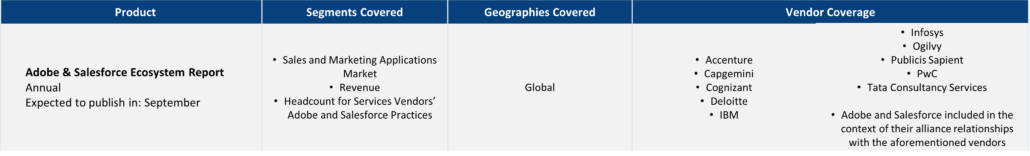

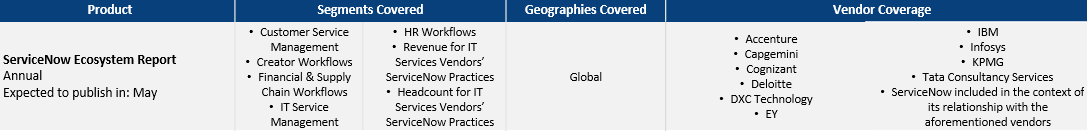

Explore TBR Digital Transformation Coverage

Ready to Level Up Your Insights?

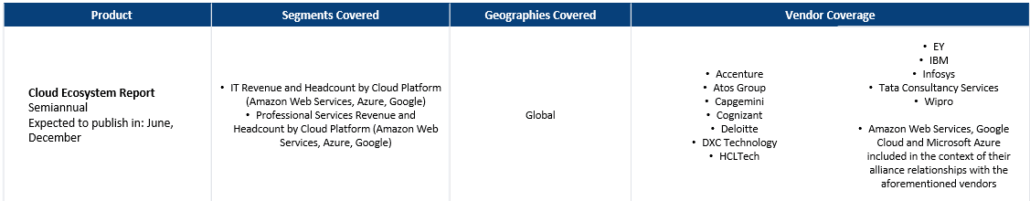

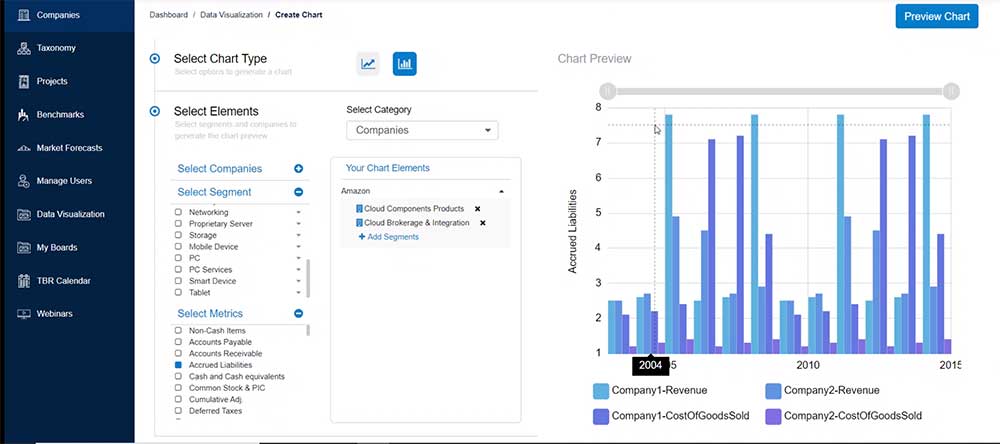

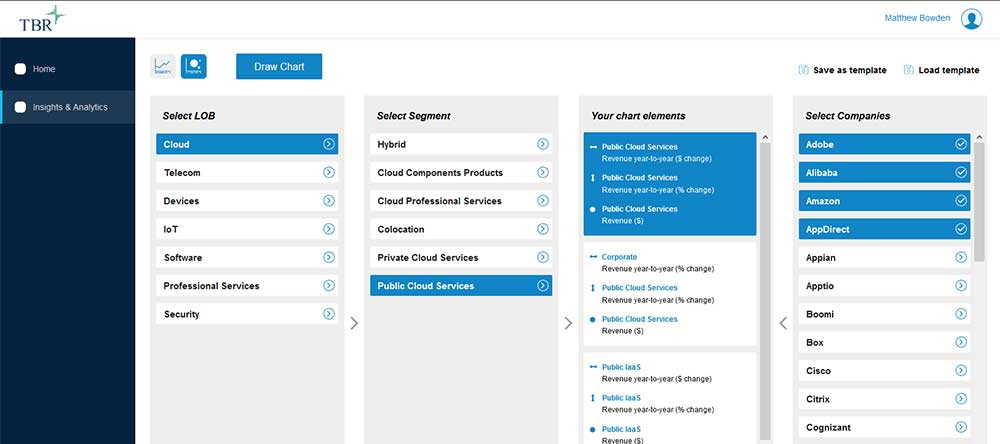

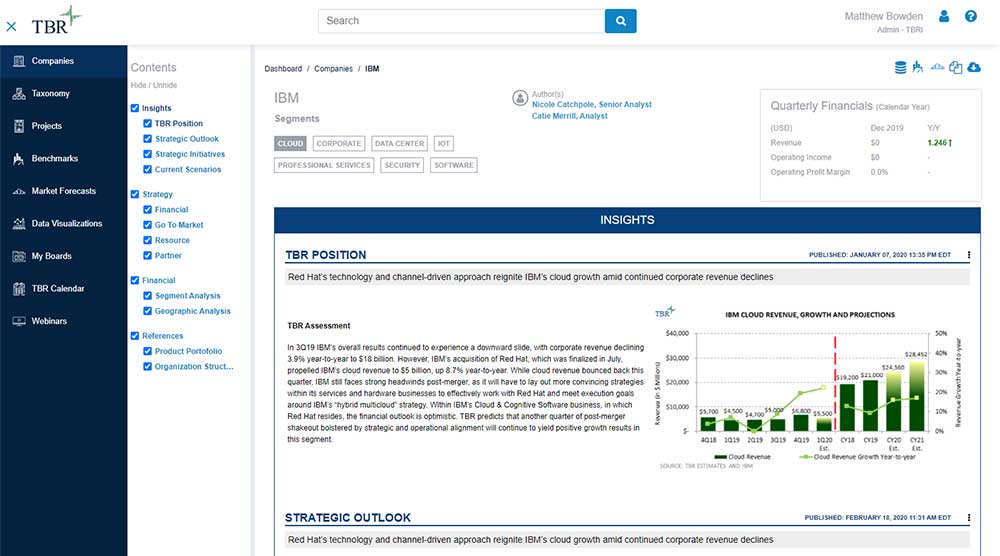

TBR’s digital-first competitive intelligence platform, TBR Insight Center™, allows for configured & customized views into IT markets, vendors, alliances and ecosystems.

Benefits delivered through TBR Insight Center™ include:

- Dynamic, configurable platform for TBR’s objective, independent and validated data and analysis

- Customizable views of millions of data points to match your specific needs

- Simple download functionality for customized views of analysis and feeds of data, saving staff dozens of hours per month

- Updates for market disruptions and emerging trends

Already a TBR Classic client but don’t have access to TBR Insight Center yet? Request access today.

KPMG-Salesforce Partnership: Evolving from Implementation to Agentic Outcome

/by Bozhidar Hristov, Principal AnalystKPMG’s alliance with Salesforce has moved from a high-growth implementation practice into a relationship increasingly defined by enterprise trust, measurable outcomes and the ability to operationalize agentic AI. Since entering Salesforce’s ecosystem in late 2019, KPMG has scaled the alliance to over 1,300 practitioners across more than 30 countries and is now repositioning the relationship around Agentforce-led transformation, AI-ready data foundations, and run/optimize operating models that sustain adoption. This shift mirrors a broader ecosystem trend: Leading platforms are prioritizing depth with a smaller set of preferred partners and evaluating alliances on their ability to drive usage, value realization and governance — not simply project throughput.

Consulting Will Rebound in 2026

/by Patrick Heffernan, Practice Manager and Principal AnalystAfter a period of relative softness, consulting revenues are expected to rebound to high-single- or low-double-digit growth as pervasive uncertainty pushes enterprises to seek external guidance. Demand will be particularly strong around risk mitigation, strategic planning and AI adoption, positioning forward-deployed engineers, supply chain management and people advisory services as leading revenue drivers in 2026.