With TBR’s Federal IT Services market and competitive intelligence research, understand and build strategies around industry trends to maximize addressable opportunity and minimize disruption as a core industry undergoes unprecedented change.

Gain insight into how defense contractors are going to market, forming alliances, planning for the future and more as they provide solutions and services tailored to customer objectives ranging from night vision goggles and underwater sensors to F-35s and Low-Earth Orbit satellite constellations.

Learn how federal contractors are approaching Joint All Domain Command and Control (JADC2), hypersonic technology, the new age space race, digital engineering and the evolving international defense scene.

A free trial of TBR’s Insights Center platform gives you access to our entire Federal IT Services research portfolio and the ability to customize and curate reports detailing our analysis based on your company’s specific needs. Start your free trial today!

Trends we’re watching in 2024:

- Will there be a government shutdown in federal fiscal 2024? How would it impact federal systems integrators?

- Is additional budget turmoil expected in 2024 in the U.S. federal contracting sector?

- Will there be a revival in M&A activity among the leading federal IT contractors?

- The competition for IT talent has eased, but remains brisk in federal IT. How are federal IT vendors adapting their human resource strategies to remain employers of choice?

- Will the 2024 U.S. Presidential election impact the federal IT market?

- How are alliance relationships between federal systems integrators and commercially focused providers of cloud, analytics and other emerging technologies continuing to evolve?

- How will GenAI impact the federal IT market in 2024?

Benchmark

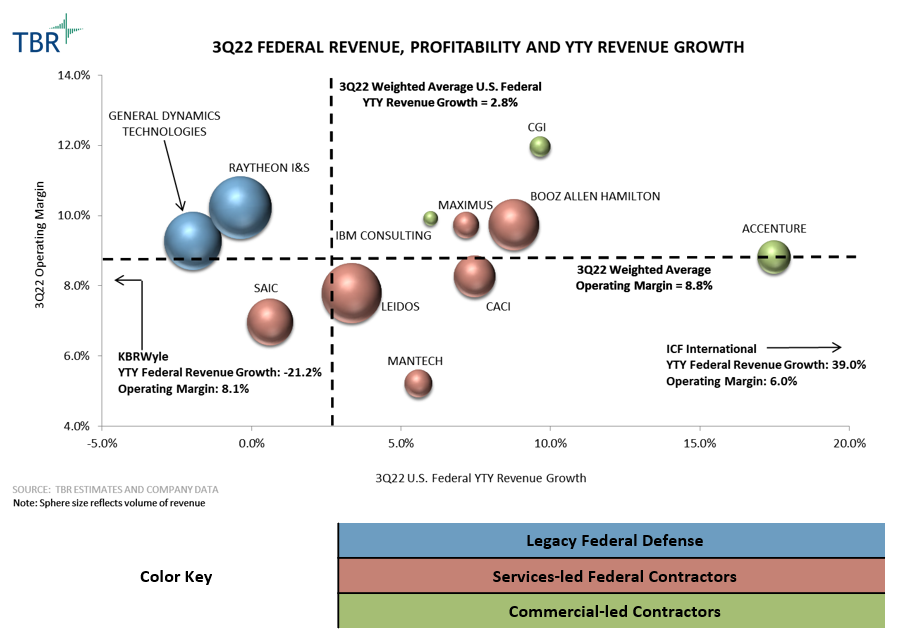

TBR’s Federal IT Services benchmark research provides clients a comparison of vendor performance in a market, including analysis on vendor strategies, financial performance, go-to-market and resource management. The research graphically portrays comparisons of vendors by myriad metrics, calling out leaders, laggards and business models.

Federal IT Services Benchmark

The federal budget landscape was persistently erratic in 2022, with unpredictable lags in technology outlays hampering IT vendor growth. Budget turmoil may linger into 2023, but federal agencies’ appetite for digital transformation and IT innovation remains intact, fueling a positive outlook for accelerating growth on a near-term horizon.

Ecosystem Report

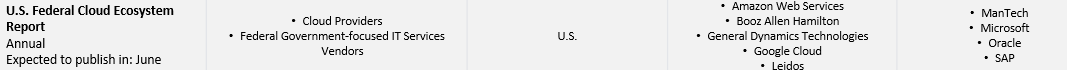

Ecosystem reports compile data and analysis from multiple streams of TBR coverage to assess, quantify and model revenues, team compositions, go-to-market strategies and other qualitative insights, including accreditation and training of sell-through and sell-with partnerships, channels or alliances across global ICT markets.

U.S. Federal Cloud Ecosystem Report

Vendor Analysis

TBR’s Federal IT Services vendor reports, profiles and snapshots provide deep-dive analysis into a single vendor across corporate strategies, tactics, SWOT analysis, financials, go-to-market strategies and resource strategies.

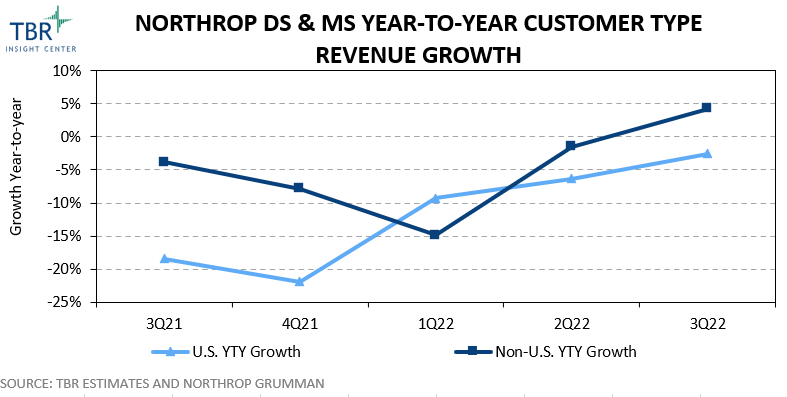

While the collective operating margin had immediately shown signs of improvement following NG’s divestment of the Federal IT & Mission Support Services lines in February 2021, it tumbled from 15.2% in 2Q22 to 13.8% in 3Q22, the same level seen in 1Q21. DS and MS have been impacted by inflation and lingering industrywide supply chain pressures while also struggling to maximize their workforce’s productivity. With indicators suggesting that the 1H22 labor availability issues are beginning to abate, the contractor is investing in stabilizing its segments’ supply chains and supporting employees with productivity-enhancing tools like digital engineering. DS’ and MS’ respective FY22 performances will finish below expectations, but MS is poised to rebound in FY23.

Accenture Federal Services

Booz Allen Hamilton

CACI International

CGI Federal Vendor Profile

General Dynamics Technologies

IBM Federal Vendor Profile

ICF International

Leidos

ManTech Vendor Snapshot

Maximus

Peraton Vendor Profile

SAIC

RTX Raytheon Vendor Snapshot

Top 2023 Takeaways for the Federal IT Services Market [Infographic]

The most intensive bull market in federal IT spending continues, and the federal IT services market will remain robust through federal fiscal year 2024 (FFY2024). Much IT modernization work has been done, but there is still more to do as federal agencies continue adopting digital technologies such as AI, analytics and machine learning, all while migrating their legacy workloads to advanced cloud infrastructures. Federal spending on technology and related services neared $120 billion in FFY2023, up over 25% from FFY2021 and on a trajectory to surpass $130 billion by FFY2025.

Peraton Could Surpass $8B in Sales in 2024, but Will It Go Public?

TBR anticipates that Peraton will continue to expand its partner network to operate as a cloud services broker. Peraton is positioning itself to capitalize on federal agencies that are increasingly utilizing an “as a Service” cloud environment model to build their own platforms with desired third-party capabilities as well as the steady funding to accelerate agencies’ digital modernization journeys, which is expected to persist for the foreseeable future.